How Can AI Simplify the Complexity of Modern Real Estate Markets?

5 min read

5 min read

Remember when real estate investment meant driving around neighborhoods, pretending to know what “good bones” meant while secretly Googling property taxes on your phone? Those days are gone faster than a bidding war on a studio apartment with “character” (translation: no working plumbing).

The modern property market has become a beast that eats spreadsheets for breakfast and laughs at your Excel formulas, making investing feel like playing three-dimensional chess blindfolded.

Enter the AI-powered real estate investment revolution, where machines do the heavy lifting while you sip coffee and pretend you saw that market trend coming. At BiztechCS , a leading AI Development Company, we build these digital property geniuses that make traditional investment advisors sweat more than a contractor giving you a “final” quote.

We can develop real estate investment assistant solutions that analyze markets faster than you can say “location, location, location” and spot opportunities while you’re still figuring out what a cap rate means.

These AI sidekicks are transforming property investment from a game reserved for the wealthy into something even regular people with bank accounts can navigate without losing their sanity or their shirts.

In today’s fast-changing property landscape, traditional real estate investment isn’t just about location anymore. It’s about keeping pace with technology, data, and market dynamics that evolve faster than ever.

Property markets now swing harder than a wrecking ball at a demolition party, making yesterday’s hot investment today’s expensive mistake. One minute you’re celebrating a brilliant purchase, the next minute interest rates spike, and your ROI calculations look like a horror movie script.

The sheer volume of market data available would overwhelm even the most powerful supercomputer. Between economic indicators, demographic shifts, and local market reports, investors are overwhelmed by a sea of information, lacking clear direction.

But here’s what executives often ask: “How much data is actually too much, and where do we draw the line?”

The answer isn’t about limiting data but rather having systems that can intelligently filter and prioritize what matters for your specific investment criteria.

Researching a single property investment now takes longer than waiting for your contractor actually to show up on the promised date. You need to analyze comparable sales, rental yields, neighborhood trends, and future development plans, just as you would when preparing for a doctoral thesis defense.

By the time you finish your due diligence, the property may have been sold or the market may have completely changed. The research rabbit hole goes so deep, Alice would have given up and bought stocks instead.

While you’re still calculating the cap rate on that duplex, three cash buyers have already submitted offers and begun renovation plans. The best deals disappear faster than free donuts at a corporate meeting, leaving you with the investment equivalent of stale breadcrumbs.

Traditional analysis methods move at the speed of a government permit office, while opportunities race by at Formula One pace. Without AI Development Company real estate market insights, you’re basically bringing a calculator to a supercomputer fight.

Trying to juggle property values, rental trends, crime statistics, school ratings, and economic forecasts makes circus performers look like they’re not working hard enough. Your brain starts smoking like an overheated laptop when you attempt to correlate interest rates with population growth while factoring in zoning changes.

Each data point affects the others in ways that would make chaos theory mathematicians reach for the aspirin bottle. The human mind wasn’t designed to process this many variables without wanting to throw the spreadsheet out the window.

Predicting real estate trends without AI in property valuation tools is like forecasting the weather by licking your finger and holding it up. You might nail it occasionally, but mostly you’re just guessing with fancy terminology to sound smart.

Market patterns have become more unpredictable than a toddler’s mood swings after eating birthday cake. Manual trend analysis belongs in a museum alongside fax machines and those who thought Bitcoin was a fad.

AI isn’t just transforming how we buy and sell properties—it’s redefining how investors discover, analyze, and act on real estate opportunities with unmatched precision and speed.

Remember when analyzing property data meant drowning in spreadsheets while your coffee turned into iced disappointment? Those days are dead. AI-powered real estate investment tools process millions of data points faster than you can say “market crash.”

We can develop custom AI algorithms that crunch through property listings, market trends, and demographic shifts in milliseconds. We’re talking about systems that analyze everything from school ratings to sewage permits while you’re still trying to remember your login password.

The beauty lies in having every piece of relevant data analyzed, cross-referenced, and served up before your competitors even open their laptops.

Crystal balls are for carnival fortune tellers, but predictive analytics for smart real estate portfolio management actually works. These AI systems spot patterns humans miss, like that weird correlation between taco truck density and property values going up.

We can implement machine learning models that learn from historical data, market cycles, and even social media sentiment to predict which neighborhoods will boom next.

Our team can build systems that forecast rental yields, appreciation rates, and market downturns with scary accuracy. It’s like having a time machine, except it’s legal and doesn’t require a flux capacitor.

The real estate market never sleeps, but you probably should unless you enjoy hallucinating about mortgage rates. Your real estate investment assistant works around the clock, scanning listings, tracking price changes, and spotting opportunities while you dream about beachfront properties.

We can implement monitoring systems that alert you to golden opportunities at 3 AM without requiring you to develop insomnia. With an AI-powered real estate investment approach, you’re never out of sync with fast-moving market shifts — your system is already analyzing and prioritizing deals while competitors are still hitting the snooze button.

Our platforms can track international markets, currency fluctuations, and regulatory changes across time zones. The system catches deals faster than a seagull diving for French fries at the beach.

A common concern from portfolio managers is: “What happens if the AI Development Company spots an opportunity at 2 AM in a market I’m not familiar with?” That’s why we build in intelligent filtering and risk assessment protocols that ensure midnight alerts are genuinely worth waking up for, not just noise that seemed essential to an overeager algorithm.

Humans buy properties because they “feel right” or have “good vibes,” which is about as scientific as choosing stocks based on horoscopes. AI doesn’t care if a property reminds you of grandma’s house or has bad feng shui.

These systems evaluate investments based on cold, hard data and projected returns, not whether the kitchen has marble countertops that match your personality. We can develop evaluation frameworks that strip away emotional bias and focus purely on ROI potential.

Our scoring algorithms can rank properties based on dozens of financial metrics while completely ignoring that charming garden gnome collection.

To truly harness the power of AI in real estate investing, your platform needs more than just smart algorithms—it needs features that turn raw data into actionable, profit-driven insights.

Manual property valuation is like using an abacus to calculate cryptocurrency returns: painful, outdated, and embarrassingly slow. ai/ml development services for property valuation automatically crunches through comparable sales, market conditions, and property features faster than a caffeine-addicted analyst on deadline day.

The system spits out valuations based on actual data, not the “gut feeling” of someone who thinks avocado toast determines market trends. Skeptical investors frequently wonder: “How can we trust AI valuations when traditional appraisers sometimes disagree by 20%? For any AI Development Company entering the real estate valuation space, addressing this inconsistency is fundamental to building credible automated systems.””

The key is that AI doesn’t replace human judgment entirely but provides a data-backed baseline that’s consistently calculated using the same criteria, eliminating the wild swings that occur when different appraisers use different methodologies.

Traditional dashboards show you what happened yesterday, which is about as useful as last week’s weather forecast for planning today’s picnic. Your real estate investment assistant forecasts future market movements, displaying potential scenarios like a crystal ball that actually works instead of being a paperweight.

These visualizations turn complex algorithms into simple graphics that even your most technophobic board member can understand without a decoder ring.

Waiting for investment opportunities without automated alerts is like standing at a bus stop in the rain without checking if buses actually run on Sundays. AI-powered real estate investment platforms send instant notifications when properties matching your criteria hit the market, before every amateur investor with a podcast floods the bidding.

These alerts filter out the garbage deals that look pretty but perform like a chocolate teapot.

How many hours do you waste analyzing properties that don’t meet your criteria? Smart investors let AI do the filtering so they only see the diamonds, not the rough.

Calculating ROI without advanced tools is like performing surgery with kitchen utensils: technically possible, but definitely not recommended. These forecasting systems simulate thousands of market scenarios, stress-testing your investments against everything from interest rate hikes to alien invasions.

The tools provide probability ranges for returns through AI real estate market insights, not just optimistic fantasies that assume markets only go up forever.

Tracking portfolio performance manually is masochistic behavior typically reserved for people who enjoy root canals and tax audits. Smart real estate portfolio management platforms monitor every property’s performance metrics in real-time, from rental yields to appreciation rates.

The system knows exactly which properties are printing money and which ones are bleeding cash faster than a Vegas weekend.

Behind every smart real estate investment platform lies a powerhouse of cutting-edge technologies working in harmony to turn complex data into clear, actionable insights that drive smarter, faster decisions.

Running AI-powered real estate investment systems on traditional servers is like racing a Formula 1 car with square wheels. Cloud-native infrastructure scales faster than your teenage nephew’s appetite at an all-you-can-eat buffet.

We can build architectures that expand or contract based on demand, so you’re not paying for unused capacity like a gym membership in February. The cloud handles millions of calculations simultaneously without breaking a sweat or demanding overtime pay. CFOs often press us on this: “What’s the actual cost difference between cloud-native and traditional infrastructure for a mid-sized portfolio?”

Typically, cloud-native solutions reduce infrastructure costs by 40-60% while processing 10x more data, though the real savings come from opportunities captured that would have been missed with slower systems.

Processing real estate data in batches is like getting yesterday’s newspaper to check today’s stock prices. Real-time pipelines stream data continuously, feeding your real estate investment assistant fresh information faster than gossip spreads in an office.

We can develop processing systems that handle thousands of data points per second without choking like an amateur sword swallower. The pipelines filter, clean, and analyze data on the fly, turning raw information into AI real estate market insights before competitors finish their morning coffee.

Reading through thousands of market reports and news articles manually is like counting grains of sand on a beach while wearing mittens. Natural language processing analyzes text data from news, social media, and reports, extracting sentiment and trends faster than rumors spread at a company merger.

Our team can implement NLP systems that understand context, sarcasm, and even real estate agent hyperbole about “cozy” meaning “smaller than a prison cell.” The technology reads between the lines better than a suspicious spouse checking text messages.

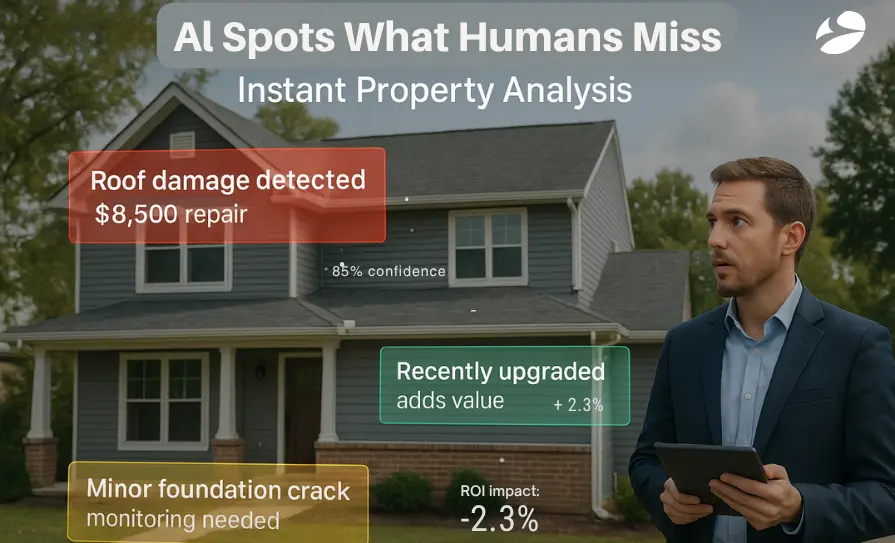

Having humans evaluate property photos is slower than teaching a cat to fetch and about as reliable. Computer vision for AI for property valuation analyzes images to assess property conditions, identifying everything from roof damage to that suspicious stain that might be mold or modern art.

We can develop visual analysis systems that spot details humans miss while distracted by staged furniture and fresh cookies at open houses. The technology evaluates thousands of property images in seconds, catching red flags faster than a matador convention.

Traditional forecasting methods predict the future about as accurately as a fortune cookie written by someone having a stroke. Advanced predictive models analyze historical patterns, current trends, and market indicators to forecast property values with scientific precision for smart real estate portfolio management.

We can create custom models that adapt to local market conditions, learning from their mistakes faster than a teenager after posting something stupid online. These models simulate thousands of scenarios, preparing you for everything except the zombie apocalypse, though they’re working on that too.

Strategic leaders consistently ask: “How long before these predictive models actually become reliable enough to base major investment decisions on?” Based on our implementations, models typically need 3-6 months of market data to establish baseline accuracy, then achieve 85-90% prediction reliability for 30-day forecasts within the first year.

Building an ai/ml development services-driven real estate investment system isn’t just about powerful algorithms. It’s about executing them with precision, consistency, and a strong focus on data integrity, usability, and adaptability.

Clean, accurate data is the lifeblood of any AI model in real estate investment — garbage in, garbage out, no exceptions. We can implement robust data validation and cleaning pipelines so that the AI-powered real estate investment platform doesn’t face embarrassing “value = 0” errors thanks to botched inputs.

Verifying each data source is essential; we can embed source-verification checks so you’re not trusting that random PDF from “Bob’s Real Estate Tips”. Regular auditing processes should be standard — our automated data-auditing systems can continuously monitor and improve data accuracy, flagging sloppy entries for review if necessary.

When training models for “real estate investment assistant” tasks, best practices are non-negotiable: use representative data, avoid overfitting, and keep your validation set honest. We can set up this framework for you, designing model training workflows that reflect the messy realities of property markets rather than ‘perfect textbook’ data.

Continuous learning must be baked in so the system adapts when a building boom or sudden regulatory change hits — we can implement mechanisms for the model to refresh and learn from new transactions, market shifts, and unforeseen events. Performance monitoring is key: we don’t just set it and forget it; we can build dashboards that track how the AI real estate market insights remain accurate, flagging drift or decay when the model starts hallucinating values like “$1 billion mansion for $50k”.

An intuitive interface matters — if your top-management “smart real estate portfolio management” tool feels like rocket-science software, the adoption will flop.

We can design the interface so that even the boardroom sceptic can get value without calling IT at midnight. Insight visualizations must be crystal clear: our team can ensure that charts, heat-maps, and property dashboards show “what’s going on” at a glance, without jargon-overload.

Mobile accessibility is a must — we can deliver solutions so the portfolio manager can check valuation swings or market alerts from their phone while stuck in traffic.

Finally, user training and support are not optional: we can provide onboarding and ongoing support so users don’t throw their laptops out of frustration when “AI for property valuation” behaves like a psychic with cold feet.

The real estate investment landscape has been flipped harder than a property bought at a foreclosure auction, with AI-powered real estate investment tools turning amateur hour into power hour for anyone brave enough to ditch their Excel addiction.

The key takeaway here is simple: while traditional investors are still squinting at spreadsheets like they’re decoding the Matrix, smart players with a real estate investment assistant are already closing deals that make sense mathematically, not just emotionally.

Early adopters of AI for property valuation gain the kind of competitive edge that makes their competition look like they’re still using carrier pigeons to send offers, except the pigeons got lost and invested in timeshares instead.

BiztechCS stands ready to build custom ai/ml development services that transform your investment strategy from “cross fingers and pray” to “data says yes, let’s make money,” because hoping for the best is not a business strategy unless bankruptcy is the goal. Partner with us to implement smart real estate portfolio management that actually works, unlike that nephew who claims he’s a real estate expert because he watched a YouTube video once.

The future of real estate investment is intelligent, automated, and data-driven, and those still relying on gut feelings might as well be reading tea leaves at the bottom of their fifth coffee cup.

Either join the AI Development Company revolution now with BiztechCS, or prepare to explain to stakeholders why the portfolio performs like a three-legged horse in the Kentucky Derby while competitors gallop past with AI real estate market insights.

Ready to transform your real estate investment strategy from guesswork to data-driven dominance? The future of property investment is here, and it speaks AI.

Artificial Intelligence (AI)

77

By Devik Gondaliya

Artificial Intelligence (AI)

76

By Devik Gondaliya

Artificial Intelligence (AI)

115

By Nandeep Barochiya