543

Saudi Healthtech: How to Achieve ZATCA Compliance & Scale HR with Odoo

5 min read

543

5 min read

Saudi’s healthtech scene is on fire right now. Vision 2030 has everyone scrambling to build the next big medical innovation, and NHIC keeps raising the bar on what “digital excellence” actually means. But here’s what nobody talks about at those glossy tech conferences in Riyadh—the absolute chaos happening behind the scenes.

The HR is struggling to hire the right talent, while CFOs are constantly stressed about ZATCA compliance. The fact is, this is the reality for nearly every healthtech startup, from Jeddah to Dammam. You’re trying to build cutting-edge medical tech while your back office is held together with spreadsheets and prayers. And let’s be honest—ZATCA’s e-invoicing requirements aren’t exactly getting simpler.

The healthtech market here is heading toward a market volume of US$1.25bn by 2030 with an annual growth rate of 4.16% (source). Naturally, everyone wants to invest. But you know what? Having a brilliant product means nothing if your operations fall apart the moment you start scaling. That’s the uncomfortable truth most founders learn the hard way.

Okay, let us understand this with an example. For instance, there is a healthtech startup that is capable of producing excellent products, but it is still operating on spreadsheets and emails, and other ancient management tools.

Now, the HR manager has like seventeen Excel files open to calculate payroll for all the employees, each of them having different allowances, overtime rates, and benefit packages. The leave tracker? Another spreadsheet, assuming everyone updated (most likely, they didn’t). GOSI filings are due, but this calculation isn’t even 50% done.

Down the hall, the finance team is wrestling with accounting software that clearly wasn’t built for Saudi Arabia. They’re manually adding QR codes to invoices, praying the XML format is correct, and crossing their fingers that ZATCA’s system accepts their submission. Oh, and those American investors want everything in USD while local operations run in SAR, which is another headache.

Here’s what happens with manual processes—everything breaks at once. Miss one overtime entry? Your GOSI calculation is wrong. Wrong GOSI calculation? Your WPS report is off. Off WPS report? Now you’ve got compliance issues. This is how easily the situation escalates from “a minor inconvenience” to “a major problem.”

You can’t run HR in one system and finance in another—not in Saudi Arabia. The regulations here are too interconnected. When ZATCA asks about your payroll expenses during an audit, they want immediate answers, not ‘give us three days to compile the data.’

The finance mess gets worse when you realize most accounting tools treat Saudi regulations like an afterthought. Phase 2 e-invoicing? That needs specialized setup that generic QuickBooks won’t handle. And forget about those “Middle East editions” of international software—they’re usually just translated interfaces with the same logic underneath.

Then there’s the eternal conflict. HR screams for faster onboarding because the business is growing. Finance demands every riyal be tracked perfectly because ZATCA doesn’t forgive mistakes. Their frustration is justified, and you are spending your fortune on solutions that don’t even align with your management.

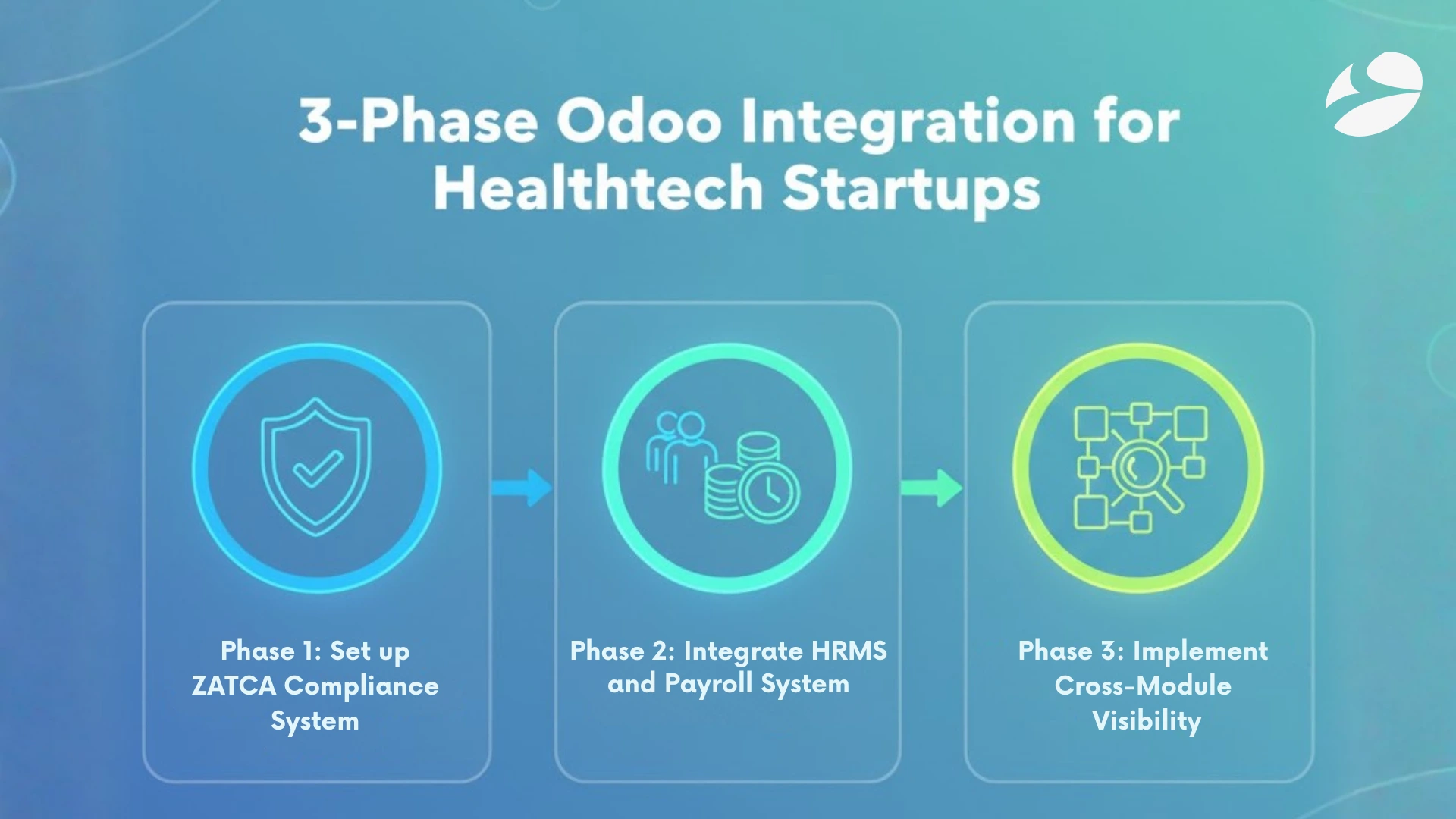

After working with dozens of Saudi healthtech companies, BiztechCS developed a three-phase approach that actually works. Not in theory—in practice, with real Saudi companies dealing with real ZATCA audits.

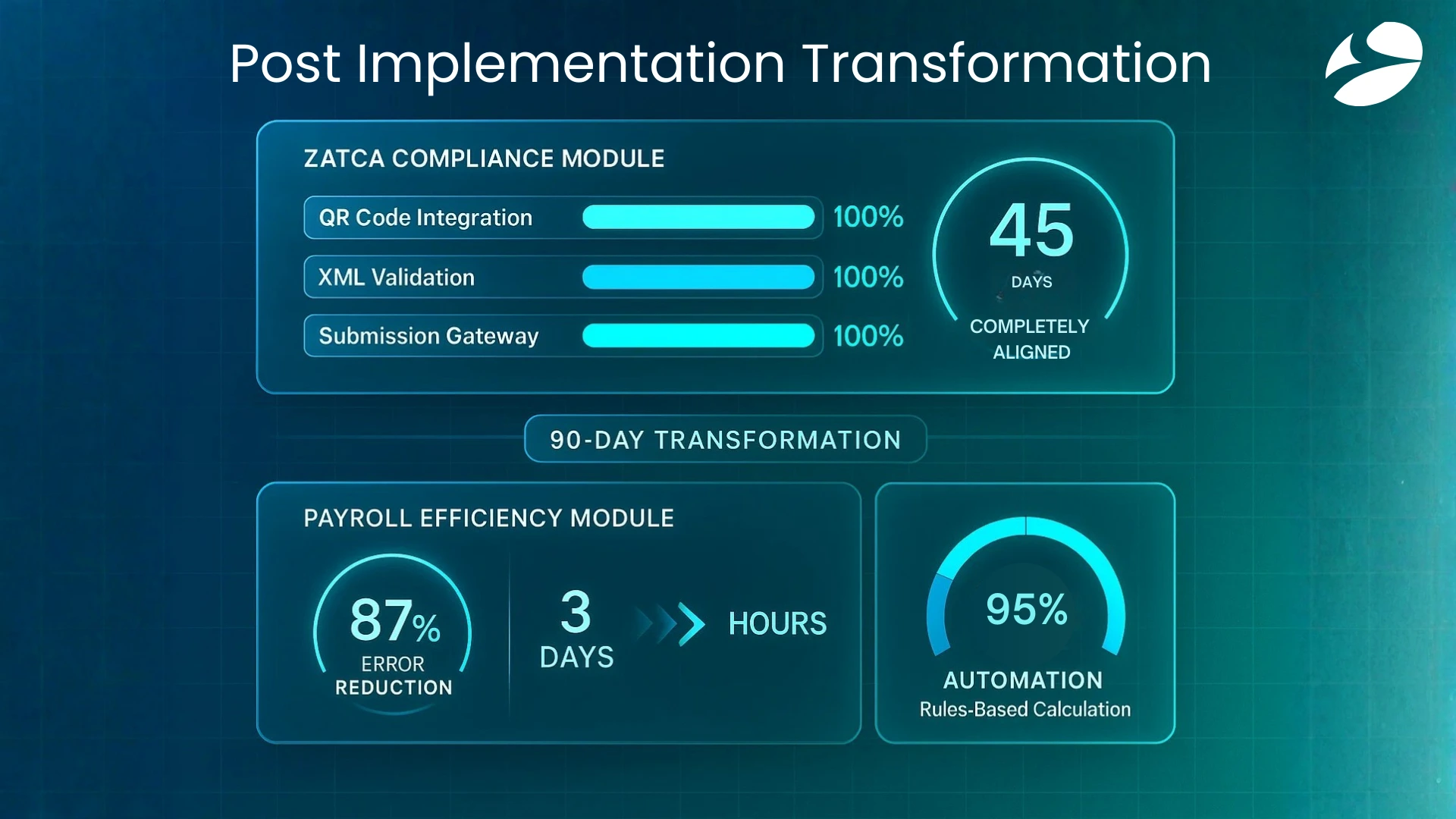

The first month is all about ZATCA. We configure Odoo to handle Phase 2 requirements automatically. QR codes generate themselves. XML validation happens before you even try to submit. The system talks directly to ZATCA’s servers—no manual uploads, no crossed fingers. When an invoice gets created, it follows the rules, simple.

For companies with international investors, we set up true dual-currency operations. Not just displaying amounts in different currencies—actually maintaining separate books that reconcile automatically. Your CFO gets dashboards that display cash positions, aging receivables, and cash burn rates, eliminating the need for manual reports.

The technical stuff matters too. We build in failsafes for when ZATCA’s servers go down (yes, it happens). We create backup procedures for network failures. Every single transaction leaves an audit trail that would make a forensic accountant smile.

Once ZATCA compliance is complete, we will integrate the HR systems. But we’re not just talking about adding HR features; we will connect them directly to the financial backbone we just built.

The HR dashboard pulls everything together. Contracts, attendance, leave balances—all in one place—no more hunting through folders or emails. Payroll runs itself based on actual attendance data, approved leaves, and documented overtime. GOSI contributions? Calculated automatically using current rates. WPS reports? Click one button, get the exact format your bank needs.

But the real showstopper is the employee portal. People check their own leave balances, download their own payslips, and update their emergency contacts. Now, some of you may think, what is so special about this, but imagine one person handling and updating the records of over 150 people. Sound tedious? Error-prone and exhausting?

Now, if all 150 of them took care of their own data? HR’s admin work will drastically reduce, since everyone is handling one record (that is their own), so the chances of errors also reduce. Now the HR department gets accurate employee information and some time to work with actual human resources.

The integration points are where things get interesting. Pay someone’s salary? The journal entries post automatically. Process a benefit claim? It hits the right cost center immediately. Approve a training budget? Finance sees it instantly. No more month-end surprises when HR and Finance finally compare notes.

HR costs become live metrics rather than abstract numbers in a spreadsheet. Business performance improves with real, accurate data rather than random guesses.

Your CEO sees exactly how much you’re spending per employee compared to revenue per employee. Trending up? Maybe slow down hiring. Trending down? Time to invest in talent. The CFO monitors benefit costs against budgets daily, not monthly. HR tracks turnover costs, including recruitment, training, and productivity losses, from numbers that were invisible before.

We will build different views for different people. So, board members see high-level metrics, department heads see their team’s data, and managers see their direct reports. Everyone gets what they need, nothing they don’t.

Some of the clients say, “The data visibility has played a crucial role in our process optimization, but can we customize reports for our investors who want specific metrics not standard in Saudi systems?”

Absolutely. We create a separate reporting layer specifically for investor updates. GOSI contributions get translated into ‘social insurance costs’ that international investors understand. Hijri dates convert automatically to Gregorian. End-of-service liabilities get explained in terms familiar to Western VCs. Same underlying data, just presented in language that makes sense to your audience.

Full ZATCA compliance is typically achieved within 45 days. By the end of 45 days, your system will be fully aligned with Phase 2 requirements. And by ‘fully aligned,’ we mean that all your QR codes work, every XML file validates, and every submission goes through easily.

Payroll errors? They will drop by around 87%. That’s not just fewer mistakes; it’s fewer angry employees, fewer GOSI penalties, and fewer late nights fixing problems. Processing time shrinks from three days to a few hours. Most calculations happen automatically based on rules you set.

In Saudi Arabia’s fast-advancing landscape, a company’s success depends on its technological expertise and operational efficiency. The choice is yours to make whether you want to drown your staff in the ocean of spreadsheets or help them sail the boat with compliance and the right talent.

At BiztechCS, our approach is not just theoretical knowledge but expertise honed through years of implementation. It’s been tested by numerous Saudi startups, refined through ZATCA audits, and proven by companies that are now scaling successfully.

You start with compliance because you have to. You add integration because it makes sense. You achieve visibility because that’s when things get interesting. So every single feature is added precisely to cater to your business needs. This is what we mean by an intentional and well-thought-out integration process.

Want to know how the right integration, the right partner can completely transform your business processes? Discuss with us and see for yourself.

Odoo

91

By Uttam Jain

Artificial Intelligence (AI)

191

By Nandeep Barochiya

Odoo

110

By Uttam Jain