434

Odoo for Micro-Lenders: Automate GST Compliance & Accounting in India

5 min read

434

5 min read

Late-night GST filing often feels less like finance and more like a horror movie marathon—where the villain is Excel, the jump scare is another missing entry, and the only thing keeping the team awake is endless cups of coffee.

For one Indian micro-lender serving hundreds of families, this wasn’t just an occasional nightmare—it was a monthly ritual. The global microfinance industry, meanwhile, is booming, projected to grow from USD 215.5 billion in 2024 to USD 239.1 billion in 2025 at a CAGR of 10.9% (The Business Research Company). Yet, despite this rapid growth, many lenders are still trapped in manual accounting practices that belong in another era.

Picture this: repayments scattered across five laptops, three flash drives, and a WhatsApp group where someone swears the “final” version of the sheet was already shared yesterday. Teams would wrestle with compliance deadlines like gladiators in an arena built from broken macros and sleepless nights. Nothing says chaos quite like reconciling thousands of micro-loans while praying no formula collapses minutes before submission.

This chaos reached a breaking point for our client. Their Finance Manager admitted: “We have to manually input loan payments, calculate interest, and track GST payments for each loan. The process is time-consuming and often leads to errors.”

With each micro-loan carrying unique interest rates, payment schedules, and GST implications, managing compliance felt less like accounting and more like conducting an orchestra where each musician was playing from a different score. Errors weren’t just inevitable—they were costly.

In India, even genuine errors or non-fraudulent GST non-compliance can attract a penalty of 10% of the tax due, subject to a minimum of ₹10,000 (ClearTax). That’s the kind of financial hit that keeps finance teams awake longer than an espresso overdose. Leadership often fears that automation will “disrupt” already overloaded teams. But the truth? The disruption already exists—it hides in late-night reconciliations, mounting errors, and looming penalties.

This is where smarter tools like Odoo step in. Instead of clunky spreadsheets and manual firefighting, Odoo offers automation designed for micro-lenders: from loan management systems that eliminate guesswork to automated loan repayment tracking that saves teams from spreadsheet-induced migraines. With Odoo’s interest calculation for micro-lending baked into the workflows, GST filings stop resembling last-minute group projects gone wrong.

More importantly, this isn’t just about automation—it’s about intelligent automation. Configured correctly, Odoo understands the nuances of micro-lending operations: partial payments, variable interest rates, processing fees, and compliance reporting. Every entry is logged, every adjustment is tracked, and every invoice is generated with precision. What was once a frantic scramble becomes a transparent, auditable process that scales with growth.

As one Odoo consultant tip highlights, configuring automated reconciliation rules tailored to micro-lending patterns can reduce manual intervention by up to 70%. The key lies in mapping the loan lifecycle during the blueprint phase—not retrofitting generic accounting workflows after the fact. That’s how our client moved from chaos to control, and how any micro-lender can turn compliance from a constant battle into a competitive advantage.

Here’s where BiztechCS’s approach gets interesting. Instead of attempting a massive system overhaul overnight (a recipe for disaster, trust me), they started with the core pain point: loan repayment tracking.

The implementation of Odoo’s Accounting module wasn’t just about replacing spreadsheets—it was about reimagining how a micro-lender could operate. The automated loan repayment tracking in Odoo system automatically updated payment schedules and calculated interest rates based on predefined terms for each loan.

Imagine the relief when loan officers no longer had to manually update hundreds of payment records daily. As payments flowed in, Odoo updated the ledger in real-time, making outstanding balances transparent and accessible to anyone who needed them. Senior finance managers often worry at this point: “If automation takes over updates, how do we ensure accountability and audits remain watertight?” The answer lies in Odoo’s audit trail. Every entry is time-stamped, every update logged, and every adjustment linked to the user—turning what was once a black hole of manual edits into a transparent, auditable system.

However, what really excited the Finance Manager was: “Can we automatically calculate the GST applicable to each loan transaction?” The answer wasn’t just yes—it was a resounding “absolutely, and here’s how we’ll make it bulletproof.” BiztechCS configured the system to automatically calculate GST on loan processing fees, interest, and repayments, ensuring every GST-related transaction was recorded with precision.

Leadership teams often wonder, “What happens when RBI regulations change or new GST slabs are introduced?” This is where proper Odoo configuration shines. The system BiztechCS built uses master data configurations that can be updated without touching the core logic—meaning regulatory changes become configuration updates, not development projects. Smart architecture today saves countless hours tomorrow.

Odoo Consultant Tip: When implementing Odoo interest calculation for micro-lending, we always build a parallel calculation engine for the first month. This shadow system validates every automated calculation against your existing methods, ensuring 100% accuracy before full cutover. It’s not about distrusting the system—it’s about building confidence across your finance team.

Now, let’s talk about the elephant in every Indian CFO’s room—GST compliance. If you’ve ever spent a weekend preparing GST returns manually, you know it’s about as enjoyable as a root canal performed by an amateur dentist.

BiztechCS didn’t just automate GST calculations; they created an intelligent compliance ecosystem. The customized Odoo system automatically generated GST reports based on real-time transactional data. Every loan-related fee, every interest payment, every repayment was accurately accounted for with the correct GST applied automatically.

CFOs often ask us, “How do we ensure the automated system captures all the nuances of our lending products—processing fees, pre-payment penalties, restructuring charges?” The answer lies in what we call ‘scenario mapping.’ Before writing a single line of code, BiztechCS documented every possible transaction type, then built validation rules for each.

This upfront investment ensured the system could handle edge cases from day one, rather than discovering them during month-end closing. And when compliance officers raise the inevitable question—“What happens when GST slabs or RBI rules shift overnight?”—the system proves its worth. With master data configurations, tax changes become a matter of quick updates, not painful rework.

The real magic happened with GST-compliant invoice generation. Previously, creating invoices was a manual process prone to errors, including incorrect tax rates, misclassified categories, and missing details. Now? The system generated perfect invoices every time, reducing error rates from a concerning 8% to virtually zero.

When board members review operational metrics, they often ask: “How quickly can we adapt when the tax department introduces new invoice formats or additional compliance fields?” This micro-lender discovered that with Odoo’s template-based approach, what once required weeks of vendor negotiations now took hours of configuration. The agility to respond to regulatory changes became a competitive advantage, not a compliance burden.

Still struggling with invoice errors that cost time and credibility? Let’s fix that once and for all.

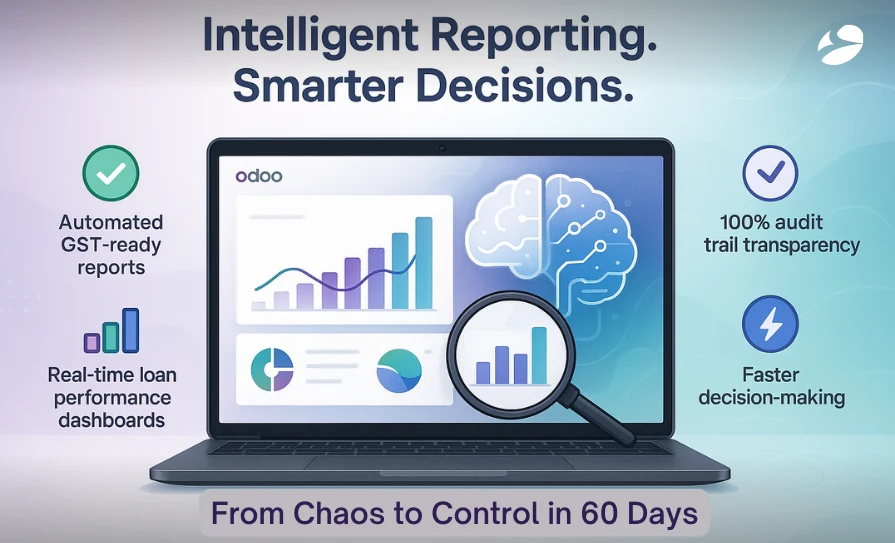

Here’s where many ERP implementations stop—basic automation achieved, mission accomplished, right? Wrong. BiztechCS understood that true transformation means building a system that doesn’t just react but anticipates.

The automated compliance checks they set up in Odoo weren’t just rule-based; they were intelligent guardians of financial integrity. Every transaction was vetted against GST requirements before processing, not after. Monthly and quarterly GST reports are generated themselves, ready for filing without manual reconciliation.

The CFO’s testimonial says it all: “Odoo has completely transformed how we handle accounting. We now have automated reports that make GST filing seamless and error-free.”

But let’s dig deeper into what “seamless” really means here. It means the Finance Manager no longer dreads month-end. This allows the accounting team to focus on financial analysis rather than data entry. It means the company can scale its loan portfolio without proportionally scaling its back-office headcount.

Naturally, board members ask: “Can this system still support us when our loan book triples or when we diversify products?” That’s exactly why BiztechCS built modular loan product templates—new offerings are simply configurations, not costly projects.

Senior executives frequently pose this challenge: “Our loan products are evolving—we’re introducing daily interest products, flexi-loans, and group lending schemes. Will the system we implement today constrain our innovation tomorrow?” This is precisely why BiztechCS architected the solution with modular loan product templates. Each new product type becomes a configuration exercise, not a customization project. The micro-lender has since launched three new loan products without writing a single line of custom code.

Odoo Consultant Tip: In our implementations, we always create a ‘loan product factory’ within Odoo—a framework where new lending products can be configured through parameters like interest calculation methods, fee structures, and repayment patterns. This approach has enabled our clients to reduce new product launch time from months to days.

📈 The Numbers Don’t Lie: Within 60 days of implementation:

Here’s something most consultants won’t tell you: the real value of a well-implemented Odoo accounting for micro-lenders system isn’t in what it automates—it’s in what it enables.

With accounting automated and compliance assured, this micro-lender could now:

Naturally, investors at the board table press further: “Do these gains just make operations smoother, or do they actually give us an edge in the marketplace?” The answer is both. Lower costs enable sharper interest rates, faster compliance ensures fewer penalties, and better data insights give lenders confidence to expand—all translating into stronger competitiveness.

Think about your own organization. What strategic initiatives are stalled because your team is drowning in manual processes? What market opportunities are you missing while reconciling spreadsheets?

Want to turn compliance headaches into a competitive advantage? The right systems can make it happen.

After guiding numerous financial institutions through similar transformations, here are the non-negotiable principles for success:

Don’t begin by asking “What can Odoo do?” Instead, ask “What’s keeping my team up at night?” For our micro-lender, it was compliance with GST. For you, it might be different.

Rome wasn’t built in a day, and neither should your ERP implementation be. Our three-phase approach—foundation, compliance, intelligence—ensures each stage delivers value while preparing for the next.

The Finance Manager, who initially feared job automation, became the system’s biggest champion. Why? Because they were involved from day one, shaping the solution rather than having it imposed. Leadership skeptics often ask: “How do we handle resistance from staff worried about being replaced?” In practice, involving them early shows automation is about eliminating drudgery, not roles. That shift in perspective turns anxiety into advocacy, as they realize the system amplifies their expertise instead of erasing it.

Track not just efficiency metrics but quality indicators. A 40% reduction in filing time is impressive, but 99% accuracy in loan accounting? That’s transformational.

Regulatory requirements change. Business models evolve. Your Odoo loan management system should be flexible enough to adapt without requiring a complete rebuild.

The transformation of this Indian micro-lender isn’t just a success story—it’s a blueprint. In just two months, they went from manual chaos to automated excellence, from compliance struggles to regulatory confidence, from reactive firefighting to proactive financial management.

But here’s the real kicker: this isn’t some unicorn scenario achievable only by large corporations with massive budgets. This micro-lender serves low-income families and small businesses—if they can transform their accounting operations, what’s stopping you?

The question isn’t whether you need to automate your accounting and compliance processes. The question is: how much longer can you afford not to?

The right time to implement Odoo ERP is before manual processes start causing errors and compliance risks. Every delay means more spreadsheet headaches, missed accuracy in loan tracking, and avoidable GST penalties. A well-customized Odoo setup ensures automation, compliance, and scalability from day one.

You’ve seen what’s possible. You understand the journey. Now comes the crucial question: what’s your first move?

Start by auditing your current processes. Where are the bottlenecks? What keeps your finance team working late? Which compliance requirements cause the most stress? Document these pain points—they’re not problems; they’re opportunities for transformation.

Consider this: the micro-lender in our story didn’t just implement software; they reimagined their entire approach to financial operations. With BiztechCS’s guidance and Odoo’s powerful platform, they built a foundation for sustainable growth.

Let’s simplify your accounting and tax filing with Odoo. Whether you’re managing a few loans or thousands, BiztechCS designs solutions that automate and streamline your financial operations. Our consultants have walked this path before, and we’re ready to guide you through your own transformation journey.

The spreadsheet era is ending. The age of intelligent, automated financial management is here. The only question remaining is: are you ready to make the leap?

Your peers are already reaping the rewards of automation—reduced errors, faster filings, and scalable growth. The sooner you begin, the sooner you leave spreadsheet chaos behind.

Artificial Intelligence (AI)

125

By Nandeep Barochiya

Odoo

212

By Uttam Jain

Artificial Intelligence (AI)

416

By Nandeep Barochiya