How Odoo Empowers UAE Wealth Advisors with KYC and Audit Readiness?

5 min read

5 min read

Compliance gaps and auditors are a nightmare. Literally – they do not directly add value to your revenue but a necessary tool for (maybe) anxiety management. Imagine there is a prominent wealth advisory firm in Dubai and they aim to keep the compliance of the highest pedigree.

And yet, their Managing Director, Sarah got a call early in the Tuesday morning from the DFSA auditor, “Your KYC documentation for high-net-worth clients shows several compliance gaps. We need complete audit trails for all client interactions, document versions, and access logs by Friday.” It happens, we have all been to the audits and pre-audits.

However, this issue here has an underlying silos of the system issue.

Sarah’s heart sinks as she reviews their ‘system’—email attachments, Google Drive folders, and manual client notes scattered across platforms. Six relationship managers maintain separate client files. KYC documents are in Arabic, English, and mixed languages. Producing audit-ready compliance documentation in 72 hours feels impossible.

“How did we get here?” This scenario is echoed by UAE wealth management firms as regulatory frameworks tighten, with AML/CFT regulations requiring comprehensive documentation and audit trails.

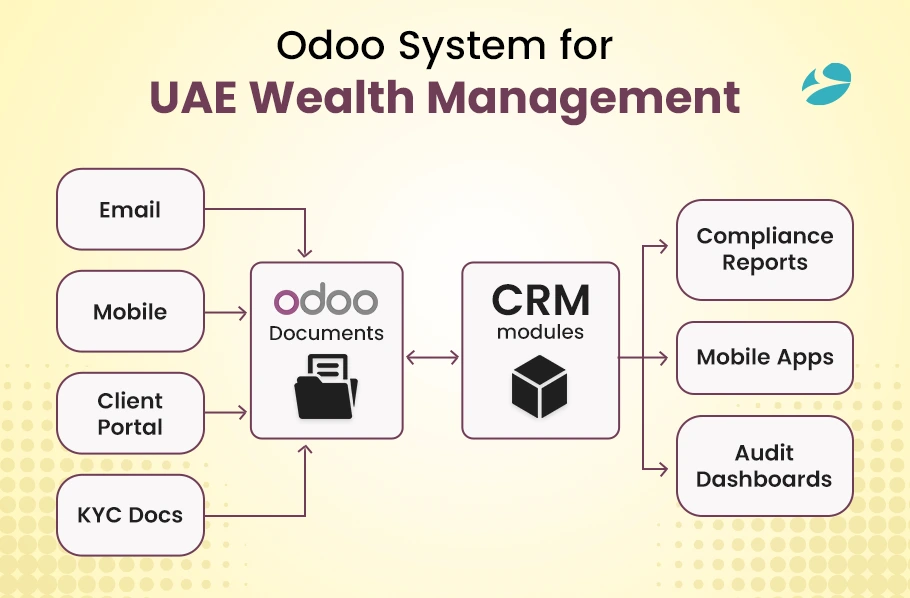

Many partners in Sarah’s position ask, “Is it even realistic to centralize all of this fragmented information without disrupting client work?” The answer lies in technology: Odoo’s Document Management creates a single source of truth where documents in multiple languages and formats are automatically tagged, versioned, and linked to client records—without requiring teams to change how they work overnight.

Does this sound familiar? Non-compliance with KYC regulations in the UAE can result in severe penalties, including fines from AED 10,000 to AED 100,000, with money laundering violations carrying penalties up to AED 50,000,000. In fact, regulators have already imposed AED 339 million in fines in 2024 alone on banks, exchange houses, and insurers (source).

Odoo Consultant Tip: When configuring Odoo Documents for multi-lingual environments like the UAE, we recommend enabling automated metadata tagging and OCR (Optical Character Recognition). This ensures Arabic and English documents are searchable and consistently categorized—removing the manual burden on advisors.

For many UAE-based wealth management firms, scaling brings complexity. What works smoothly with 50 clients becomes overwhelming with 500. On top of that, 78% of Middle East wealth clients now expect digital-first advisory channels, meaning firms must scale compliance and client servicing together (source). Processes that seem manageable in a single office can become compliance risks when spread across multiple locations.

This is especially relevant now, as the DIFC saw a 62% increase in authorized wealth management entities in the first half of 2024. With that kind of growth comes increased regulatory attention, and firms need more than just good intentions—they require systems that are designed for insight, consistency, and control.

The real challenge isn’t just staying compliant. It’s about having the right technology foundation to support compliance, without slowing down daily operations or client service. Senior partners often raise the concern: “Won’t embedding compliance into every workflow slow down our advisors?” In reality, Odoo reverses that problem. By integrating compliance checkpoints directly into daily operations, advisors spend less time chasing files or clarifying document versions and more time serving clients. Compliance teams, meanwhile, gain oversight without forcing advisors into extra manual processes.

That’s where our expertise comes in. At BiztechCS, we can implement and configure Odoo Document Management and CRM systems tailored to the needs of growing wealth firms. These solutions create automatic audit trails, ensure structured workflows, and free up advisors to focus on what they do best, while compliance teams retain complete control over strategy and oversight.

Does scaling your client base feel like a compliance risk? See how structured workflows and automated audit trails keep your firm both efficient and regulator-ready.

Wealth management firms in the UAE are often burdened by fragmented systems, with client data scattered across emails, spreadsheets, and handwritten notes. This not only creates inefficiencies but also compromises data integrity and compliance. A strategic Odoo implementation can address this, streamlining operations and providing firms with better visibility and control.

The Challenge Scenario: Client information is fragmented. Advisors dig through emails for old attachments, track investment updates in Excel, and rely on memory or sticky notes for follow-ups. It’s a workflow built on silos.

The BiztechCS Implementation Approach: With our experience in Odoo customization, we configure a robust, centralized system that supports fast-paced wealth management teams:

Potential Impact: Advisory teams access the same set of up-to-date documents from a single system. No more chasing files or second-guessing document versions. But leadership inevitably asks, “What about security when we’re dealing with high-net-worth client data?” Odoo addresses this by enforcing role-based access controls, encryption, and detailed access logs. Every view, download, or edit is recorded, giving both clients and regulators confidence that sensitive data is handled securely.

Odoo Consultant Tip: Always configure ‘least privilege access’ as the default in Odoo. Our consultants advise setting up granular role hierarchies early—this prevents accidental overexposure of client files and reduces rework during later compliance audits.

The Operational Challenge: As firms grow, keeping track of document versions, communications, and client interactions becomes overwhelming. Without centralized workflows, it’s easy to lose important data or delay client responses.

The BiztechCS Solution Framework: We elevate operations by deeply integrating Odoo CRM with document workflows to support seamless, end-to-end client management:

We can configure Odoo’s document management system with custom fields and workflows that mirror wealth management processes. This creates the structure needed for compliance documentation while maintaining operational efficiency.

The potential result is that relationship managers can instantly access complete client interaction histories, document repositories, and communication logs from a single interface. This isn’t just about convenience—it matches client expectations. 54% of UAE investors speak with their adviser at least once a week. Moreover, 82% demand multi-channel availability to build trust and responsiveness (source).

For compliance officers, the bigger question is, “How does this integration actually help when regulators demand evidence?” Because every email, call log, and document version is automatically time-stamped and linked to the client record, Odoo produces an audit trail that can be exported directly into regulator-ready reports. This eliminates the scramble of piecing together fragmented data at the last minute.

Odoo Consultant Tip: To streamline regulator reporting, we recommend pre-building export templates in Odoo for DFSA or Central Bank audits. This way, compliance teams can generate regulator-ready reports in minutes—no manual formatting or last-minute adjustments required.

The Growth Challenge: Systems must perform under real-world pressure and scale with business growth while maintaining performance.

The BiztechCS Technical Architecture: Our comprehensive system design approach could include:

Potential Outcomes,

This leads to another practical concern many CFOs or compliance heads raise: “Can the system adapt to regulator-specific formats like DFSA or UAE Central Bank requirements?” The flexibility of Odoo allows automated generation of regulator-ready reports. Firms can configure templates once, then reuse them for recurring audits, saving both time and risk of manual error.

Is your system ready for DFSA or UAE Central Bank requirements? See how Odoo’s flexibility ensures audit-ready compliance while driving growth.

Odoo implementations for UAE wealth advisors come with unique challenges, but each can be solved with the right approach.

Typical Scenario: “We have 10 years of client documents in different formats—how could we migrate without losing information?”

BiztechCS Solution:

Odoo Consultation Tip: During migration, we strongly advise creating a parallel sandbox in Odoo where legacy data is tested before full import. This allows wealth firms to validate data mapping without interrupting daily operations—a small upfront step that prevents costly errors later.

Common Concern: “We use several other systems—how do we ensure everything works together?”

BiztechCS Solution,

Common Concern: “How do we ensure our team adapts to the new system without disruption?”

BiztechCS Solution,

Still, executives often want measurable proof: “How do we know the investment is actually paying off?” Success is measured not only through adoption rates but also reduced time spent on compliance tasks, improved data retrieval speed, and ultimately, the ability to pass audits with zero last-minute firefighting. When the system runs quietly in the background and compliance becomes a non-event, that’s the clearest indicator of ROI.

Odoo Consultant Tip: To track ROI effectively, configure Odoo dashboards to measure KPIs such as document retrieval time, compliance task completion rates, and audit readiness scores. These live dashboards provide executives with concrete proof of system value—beyond anecdotal feedback.

Common Concern: “How do we ensure compliance with UAE regulations and maintain data security?”

BiztechCS Solution,

The UAE’s wealth management sector continues to experience unprecedented growth, bringing both opportunities and challenges. Regulatory requirements are evolving, client expectations are rising, and operational complexity is increasing.

The transformation we’ve outlined demonstrates what’s possible with proper system implementation,

The question isn’t whether you need better systems—it’s whether you’re ready to implement them properly.

The firms that will thrive in the next decade are those that invest in robust, scalable, well-implemented technology solutions today. Those that continue with fragmented systems may find themselves unable to compete effectively or meet evolving regulatory and client expectations.

Wondering what seamless operations could mean for your wealth management practice? Explore how the right technology foundation sets you up for long-term success.

Artificial Intelligence (AI)

239

By Nandeep Barochiya

Odoo

281

By Uttam Jain

Artificial Intelligence (AI)

532

By Nandeep Barochiya